News

Drones 'could contribute £45bn to UK economy by 2030'

<p>Drones could contribute up to £45bn to the UK economy by 2030, a new report predicts. The PwC study, Skies Without Limits v2.0, also estimates that commercial drones will save businesses £22bn, drastically cut carbon emissions, and that ... Read More

PwC report highlights the exciting potential of the commercial drone industry;

Study says drones could contribute up to £45bn to the UK economy by 2030;

It also predicts that there will be more than 900,000 commercial drones in the UK's skies; carbon emissions could be reduced by 2.4m tons; and 650,000 jobs could be associated with the drone economy - all by 2030;

PwC report describes drones as a key part of the Fourth Industrial Revolution, carrying out tasks quickly, safely and cost-effectively;

However, PwC says work is needed to help realise this potential, such as changes to legislation, including opportunities around routine BVLOS operations;

heliguy™ helps drone programmes start and scale through an end-to-end ecosystem of consultancy, product supply, in-house repairs, drone pilot training and dedicated surveying team.

Drones could contribute up to £45bn to the UK economy by 2030, a new report predicts.

The findings are published in PwC's Skies Without Limits V2.0: A follow-up to an initial study published in 2018.

The report states that commercial drones have the potential to make a significant impact on UK productivity, but there is much to do to realise this, including the evolution of industry legislation, such as moving towards routine BVLOS operations.

If the potential is unlocked, then PwC predicts the following:

Drones could contribute up to £45bn to the UK economy

More than 900,000 drones could operate in the UK's skies

£22bn in net cost savings may be realised

Carbon emissions could be reduced by 2.4 million tons

650,000 jobs could be associated with an economy that fully adopts drones

The report describes drones as a key part of the Fourth Industrial Revolution and continues: 'Drones offer public and private organisations an opportunity to carry out tasks faster, safer, cheaper and with less impact on the environment than transitional methods.'

As an industry leader, heliguy™ provides end-to-end support to enable drone programmes to start and scale. This ecosystem includes consultancy; hardware supply (including drone rental service) of DJI drones, fixed-wing aircraft and cameras/sensors; in-house repairs; drone training; dedicated surveying team; and fast logistics.

The PwC report focuses on 'commercial drones', excluding hobbyist drones, UAS which transport passengers and counter-drone solutions.

UK 2030: Economic Impact

The report takes numerous factors into consideration, such as the post-Covid landscape and the current economic climate.

With this in mind, PwC states: 'The need for drone adoption is now paramount more than ever. Businesses faced with smaller markets and higher operating costs will benefit more from new technologies, such as drones, that can help bring significant cost savings'.

And while the figures are best case scenario - showing the 'potential size of the economic prize' - they do make for positive reading.

Cost Savings

PwC predicts that drones will save businesses an estimated £22bn by 2030.

According to the study, the largest cost savings are associated with the Public and Defence, Health and Education sector (4.6bn).

There are also significant cost savings associated with Agriculture, Mining, Water, Gas and Electricity (£4.4bn) and Transport and Logistics (£4.2bn).

The report states: 'Overall, drones are more efficient than traditional approaches and have the potential to generate a significant cost saving by 2030'.

The table below shows the predicted cost savings by industrial sector in 2030, based on a best case scenario.

Industry Sector | £bn | % of 2030 GDP |

Public and Defence, Health & Education | 4.6 | 0.9% |

Agriculture, Mining, Water, Gas and Electricity | 4.4 | 3.5% |

Transport and Logistics | 4.2 | 3.5% |

Wholesale, Retail Trade, Accommodation and Food Service | 3.7 | 0.7% |

Financial, Insurance, Professional and Administrative Services | 3.0 | 0.3% |

Construction and Manufacturing | 1.6 | 0.4% |

Technology, Media and Telecommunications | 0.9 | 0.4% |

Total | 22.4 | 0.8% |

GDP Impact

The report predicts that drones can contribute up to £46bn to the UK economy by 2030, adding: 'Cost reductions combined with efficiency improvements from drone usage can help the UK economy address its long-term productivity challenge'.

PwC states that all industry sectors listed in the report will gain economically from adopting drones, with the Public and Defence, Health and Education; Agriculture, Mining, Water, Gas and Electricity; and Transport and Logistics sectors expected to see the largest monetary gains.

'The businesses that benefit most from a GDP perspective are the ones that are able to adopt and capitalise on the cost savings associated with drones more quickly than their competitors and in turn reinvest those cost savings whether that be in more drone related technologies or other business priorities,' the report states.

The table below shows the impact of drone adoption on GDP by industrial sector in 2030.

Industry Sector | £bn | % of 2030 GDP |

Public and Defence, Health & Education | 14.1 | 2.6% |

Wholesale, Retail Trade, Accommodation and Food Service | 13.3 | 2.4% |

Financial, Insurance, Professional and Administrative Services | 7.0 | 0.7% |

Agriculture, Mining, Water, Gas and Electricity | 3.0 | 2.4% |

Transport and Logistics | 2.8 | 2.3% |

Construction and Manufacturing | 2.8 | 0.6% |

Technology, Media and Telecommunications | 2.4 | 1.2% |

Total | 45.4 | 1.6% |

PcW says that its GDP estimates are 'net' figures, after substitution and displacement effects.

Jobs

PwC says that the impact of drones on jobs strongly suggests that drone adoption will enhance workforce productivity and create new roles associated with drone operation.

In line with the GDP analysis, PwC's modelling does not suggest these will be net additional jobs, but jobs where significant role changes will occur in the process of drone adoption.

PwC estimates that 270,000 jobs could be directly affected, with drone adoption augmenting people's jobs. In addition, PwC predicts 380,000 jobs will benefit from drone adoption via the reinvestment of profits created in the drone economy; efficiency gains; and investors who benefit from the wider economic effects of drones.

PwC does concede that some jobs could be lost through drone adoption, but concludes that around 650,000 full-time equivalent workers in the UK economy will benefit.

Drone Numbers

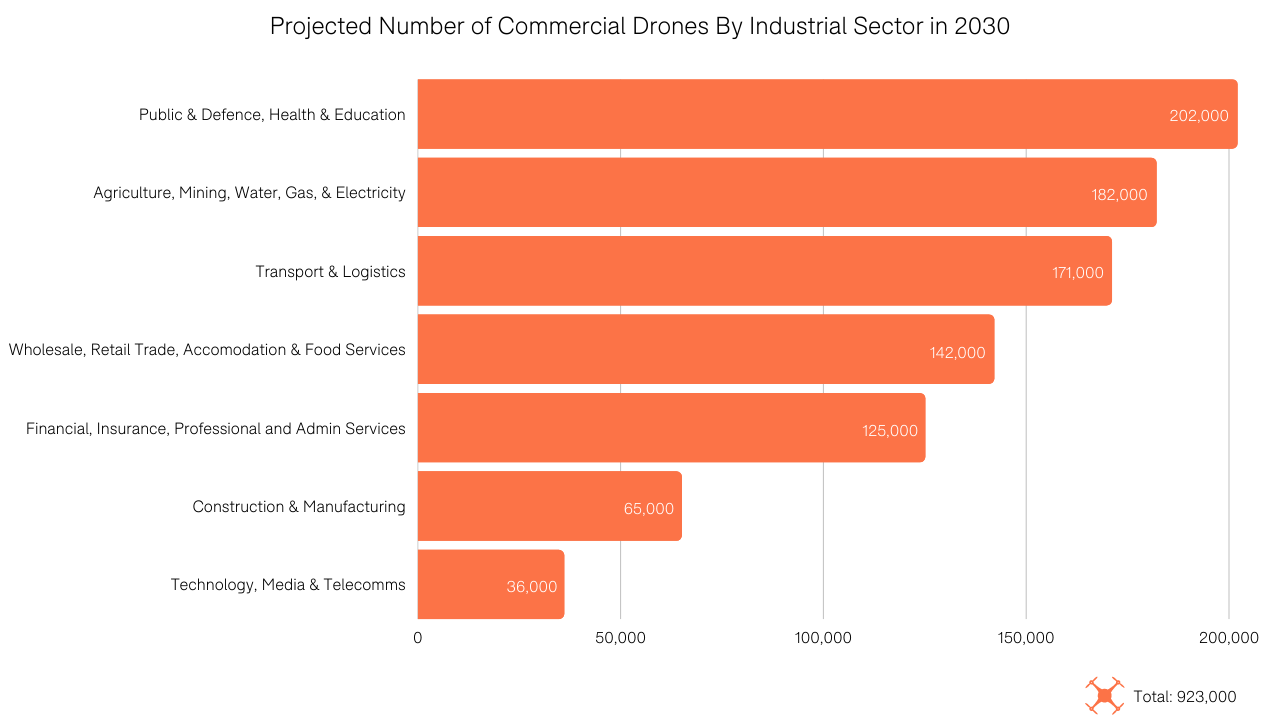

Running in tandem with the economic growth forecast, PwC estimates that there will be more than 920,000 drones being used by commercial organisations and government in 2030.

The graph below shows the predicted industry split.

Unlocking Drone Potential

The headline economic figures outlined in the report show the exciting potential of commercial drones.

However, to truly realise these benefits, PwC states that tere are 'many challenges to overcome'. These include public perception, the effective use and management of drone data, and the evolution of drone legislation.

PwC also references the value of upskilling commercial drone pilots, with specific mention of Continuing Professional Development (CPD) courses. heliguy™ runs CPD courses for the emergency services and enterprise organisations, as well as other courses to help expand careers in the UAS industry, such as the Level 5 UAS Operations Managers course.

Drone Data

Drone use provides huge benefits to organisations.

However, PwC highlights the importance of high-quality drone data, saying: 'Drone information must be fit-for-purpose and integrated with business-as-usual workflows and IT systems'.

The report continues: 'Effective drone implementations require a disciplined focus on capturing data that is of the appropriate quality, processing this data into actionable information that meets or exceeds existing information requirements, intuitively sharing the information with all stakeholders and integrating it with business as usual'.

Drone Technology

The report states that drones are at the cutting edge of robotics and AI, powered by advances in materials, communications software and battery life. Industry-leading UAS include the DJI M300 RTK and M30 Series.

However, PwC highlights four categories which are required to help realise the economic projections in the report. These are:

UTM: Fully-integrated Unmanned Traffic Management with manned traffic management, capable of dealing with the significant increase in traffic volume by adding drones.

Detect And Avoid: Ensuring drones can avoid crashing into obstacles or other air users.

Autonomy: Beyond the implied autonomy in the Detect and Avoid point mentioned above, the ability to safely conduct mission without constant one-to-one pilot input.

Infrastructure (digital/physical): Including high bandwidth and low-latency communications to ensure safe and effective drone operations and take off, landing and charging facilities for certain use cases, ie drone in a box like the DJI Dock.

Moves are happening in the industry to bring the above points forward and evolve this ecosystem of technology. heliguy™ is involved in these industry discussions.

Drone Legislation

Innovative technology runs hand-in-hand with legislation, and the report acknowledges that current regulations must evolve to allow further drone use cases.

One of the biggest topics for discussion is the evolution of regulations to allow routine BVLOS flights in unsegregated airspace.

The report adds: 'Routine BVLOS may improve the economics of an already compelling inspection and/or survey use case. There is also significant potential for use cases which, in the main, require routine BVLOS, such as last mile delivery of food and parcels'.

While BVLOS operations are in their adolescent stage, PwC acknowledges that there are 'encouraging initiatives in the UK' such as the CAA's Innovation Hub 'sandbox' and the Future Flight Challenge which is well positioned to accelerate the commercialisation of use cases that rely on routine BVLOS.

heliguy™ also has an OSC (Operating Safety Case) consultancy to help people obtain special permissions to expand the capabilities of their operations, such as EVLOS flights and reduced separation distances.

PwC Report: Summary

PwC's latest report shows the huge potential of the drone industry and the positive impact it can have on the UK economy.

Commercial drones have already shown their value and releases such as the DJI Dock drone in a box make for an exciting future.

Of course, certain legislative limitations need to be unlocked to accelerate the gains, but the opportunities are vast.

And heliguy™ will be at the forefront of this exciting new frontier, supporting drone programmes at every stage and helping to evolve the industry.

Contact us to discuss starting or scaling your drone prgramme.